HOW ALGORITHMIC TRADING STRATEGIES

WILL TRADE YOUR ACCOUNT AUTOMATICALLY

– EXPLAINED BY THE SYSTEM DESIGNER

ACHIEVE DIVERSIFICATION IN YOUR PORTFOLIO

WITHOUT TRADING IN AND OUT OF POSITIONS YOURSELF

Now you can achieve diversification in your portfolio without trading in and out of positions – the AlgoTrades algorithmic trading strategy uses liquid exchange traded funds and ES mini futures contracts to trade the S&P 500 index. This ensures you are not exposed to volatility in one stock or sector, providing you with peace-of-mind and consistent positive results.

You will benefit from the three-in-one strategy the system uses: by combining trend-following, counter-trend trading and range bound cycle algorithms into a single system, you receive consistent returns with a completely automated system that will grow your account with consistent returns.

You may fund your account with up to $300,000 per subscription and obtain all the advantages of 100% hands-free trading, previously available only to the largest institutions and hedge funds.

YOU GET THE ADVANTAGES OF THREE ALGORITHMIC TRADING STRATEGIES IN ONE SYSTEM

Once you subscribe to AlgoTrades your account is always traded with a sophisticated, three-in-one trading system. By combining the different approaches seamlessly into one unique algorithmic trading system you get the following strategies that work together to minimize risk while maximizing the probability of gains.

1. Short-term momentum shifts between overbought and oversold market conditions are traded using long and short positions allowing profits in either market direction.

2. Trend-following takes advantage of extended multi-month price movements in either direction.

3. Cyclical trading produces profits during a range bound sideways market. Some of the largest gains achieved by the system are during choppy market conditions.

ACHIEVE CONSISTENT PERFORMANCE REGARDLESS OF MARKET CONDITIONS

Your account, when traded by AlgoTrades, will benefit from reduced portfolio volatility, due to the low correlation to stock market returns obtained by the system’s rules. You gain the advantage of intricate risk management rules through the use of algorithmic trading strategies.

You don’t have to ride the stock market roller coaster any more. You will reach your financial goals sooner as your account’s performance is now traded using state-of-the-art research and properly managed positions.

SUCCESSFUL RISK MANAGEMENT DONE FOR YOU

AlgoTrades uses algorithmic trading strategies that are not market-neutral or hedged. But are usually in the same direction as the major trend, whether price is moving up, down or sideways. Risk management is always a priority in all the positions taken by the system.

You can automatically manage your risk while achieving attractive returns by using AlgoTrades algorithmic trading strategies in your account.

Generate Consistent Long-Term Growth

Everything you need to generate consistent long-term growth is now available in the AlgoTrades automatic trading system.

You no longer have to follow the market on a tick-by-tick basis. By using AlgoTrades’ algorithmic trading strategies, you will have a unique, proprietary trading system working for you 24 hours a day.

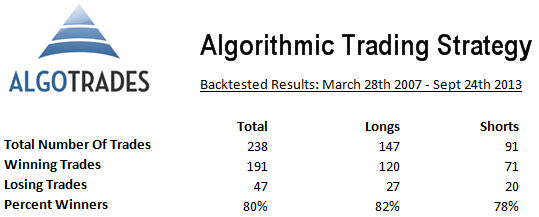

How AlgoTrades Works

The system trades the ES mini futures contract with both long and short positions and also trades exchange traded funds. Trades are typically held for ten days, and the system generates an average of 36 trades per year.

AlgoTrades’ number one priority is to always maximize profits and reduce risk. Initial protective stops are 3% or less from the entry price.

How Position Management Is Used To Extend Profits

AlgoTrades uses a dynamic position management system which actively trims or adds contracts during overbought or oversold market conditions.

Multiple positions are often open to maximize profits. Recent winning trades can still retain a partial open position to generate an even greater profit.

Minimum Account Size Required For System To Trade

You will need to fund a $35,000 margin account at one of the several brokerages currently compatible with the AlgoTrades automated trading system.

The system strategy trades in blocks of three contracts per trade. Each position is broken into thirds allowing for quick partial profit taking. A larger gain on another third allows us to take advantage of trends that continue for an extended period of time in order to produce even greater profits.

LEARN DETAILS ABOUT THE STRATEGIES

USED TO TRADE YOUR ACCOUNT

Since the market does not always provide quality trading opportunities, the system may sometimes not trigger a trade for 30+ days. During repeated trend reversals AlgoTrades may require up to six months before a new trading account high is reached (New High Water Mark). While the system ordinarily does exceptionally well during choppy markets, each trend reversal can produce losing trades. This is typical with all algorithmic trading strategies.

When a trend reversal occurs, the most recent position entered is likely to have all three contracts open, which can produce losses as high or higher than $7500 per trade. Although not common, this can be expected to happen occasionally . The average loss per trade is $3,187.50. Because algorithmic trading strategies have a high win ratio, losing trades can be larger than the average winning trade while the system continues to generate gains. Review the trade history to see in detail how the system has performed in up, down, sideways and trend reversals.

ALGORITHMIC TRADING STRATEGY NOTE

Each year, the stock market reaches a sweet spot where 80% of the system’s gains are generated. Commitment to the algorithmic trading system over a period of six months minimum is important for long term success.

ALGORITHMIC TRADING STRATEGY NOTE

The successful methodology used by the AlgoTrades algorithmic trading system was first developed in 2007. In the last two years the rules used have been converted to a completely automated system. After a six-year period of extensive backtesting, manual reviewing of each trade and position adjustments, AlgoTrades is now available for individual investors. For the first time, you have access to the same technology used by the pros, hedge funds and private equity firms on Wall Street.

The algorithmic trading strategies used by the AlgoTrades system uses several data points to power its decision making and trades. Using cycles, volume ratios, trends, volatility, market sentiment, and pattern recognition puts the probability in your favor. AlgoTrades uses three different algorithmic trading strategies and identifies the best strategy for current market conditions. Then, it automatically trades for you. All trades are entered as market orders for each algorithmic strategy in play. These strategies ensure the best possible price and performance possible.

AN IMPORTANT ALGORITHMIC TRADING STRATEGY FEATURE & BENEFIT: When a futures contract is nearing expiration, the system will automatically close out the front or nearby contract and re-establish the position in the new front or nearby contract month. No action is required on your part. It’s a true hands-free trading strategy, where all the details are taken care of for you.