Algorithmic Trading – The New Way of Investing for Peak Performance

Algorithmic Trading – In today’s hyper-competitive and cost-conscious trading environment, fund managers and buy-side traders have turned to computerized algorithms for trading their risk capital. Trades executed using algo trading programs are also known as algorithmic, black box, and mechanical trading systems.

Algorithmic trading can be explained as placing a buy or sell order of a defined quantity into a quantitative model that automatically generates the timing of trades and the position size. Orders are based on goals specified by the guidelines and constraints of the active algorithm operating.

The rules built into the model attempt to determine the best time for an order to be placed that will cause the least amount of impact on the financial instrument’s price. Algorithmic trading is a way to codify a trader’s investment strategy. Algo trading or computer-directed trading cuts down transaction costs. It allows fund managers to take control of their own trading processes rather than having a room full of employees manually placing orders.

– What does algorithmic trading mean to the buy-side and sell-side firms?

– And how will it impact the technology spend?

– Is it really as important as the buzz suggests, or is it just another trend that is being hyped up so much that everyone feels they have to ride the wave?

Aite Group, a Boston-based consultancy firm, expects traditional buy-side firms to account for 30 percent of all algorithmic trading – nearly double the current figure.

Wondering what a buy-side firm is? – Investopedia Definition

The side of Wall Street comprising the investing institutions such as mutual funds, pension funds, and insurance firms that tend to buy large portions of securities for money-management purposes. The buy-side is the opposite of the sell-side entities, which provide recommendations for upgrades, downgrades, target prices, and opinions to the public market.

Together, the buy-side and sell-side make up both sides of Wall Street.

For example, a buy-side analyst typically works in a non-brokerage firm (i.e., mutual fund or pension fund) and provides research and recommendations exclusively for the benefit of the company’s own money managers (as opposed to individual investors). Unlike sell-side recommendations meant for the public, buy-side recommendations are not available to anyone outside the firm. In fact, if the buy-side analyst stumbles upon a formula, vision, or approach that works, it is kept secret.

Buy-side firms are gravitating toward rules-based systems. For example, instead of placing a 100,000-share order, an algorithmic trading strategy may push 1,000 shares out every 30 seconds and incrementally feed small amounts into the market over the course of several hours or the entire day.

By breaking their large orders into smaller chunks, buy-side institutions are able to disguise their orders and participate in a stock’s trading volume across an entire day or for a few hours. The time frame depends on the traders’ objective, how aggressive they want to be, and constraints such as size, price, order type, liquidity, and volatility of the stock and industry group. More sophisticated algorithms allow buy-side firms to fine-tune the trading parameters in terms of the start time, end time, and aggressiveness.

Algorithmic trading is appealing to buy-side firms because they can measure their trading results against industry-standard benchmarks such as volume-weighted average price (VWAP) or the S&P 500 and Russell 2000 indices.

Algorithm trading volumes are currently driven by sell-side proprietary traders and quantitative hedge funds. In their never-ending quest to please their customers, being the first to innovate can give a broker a significant advantage over the competition, both in capturing the order flow of early adopters and building a reputation as a leader.

Algorithmic (Algo) Trading – What Is It?

Algo trading is any trading activity carried out with the help of a rule based strategy operated by a computer without human intervention. It can be formally defined as placing a buy or sell order of a defined quantity into a quantitative model that automatically generates the timing of orders and the size of orders based on goals specified by the algorithm. Or in a simple language “Algorithmic trading is about using a set of rules to finesse trade execution”

Why Are Firms using Trading Algorithms?

There is a number of reasons why many funds or big financial institutions have been attracted, including the following:

1. Algorithms have no emotions. Novice traders lose a lot of money because of their emotions (see the many books devoted to trading psychology). One classic response is to panic and sell something when the price drops rapidly. Sometimes this is the right thing to do, and sometimes it’s the wrong thing to do. But fear alone should never be a reason to sell. An algorithm will never make a decision based on fear.

2. Execution of trades is very quick. Computers can perform computations and place orders exceptionally quickly. A trading algorithm running on a dedicated server can react to changing situations in milliseconds, while human traders cannot even make a decision in that time.

3. If an algorithmic system is in tune with the current market conditions, large amounts of money can be accumulated quickly.

The chart below shows how cumulative return from an Algo trading system performed vs. S&P 500 index. Algo trading can beat the S&P 500 in an uptrend or downtrend if built correctly.

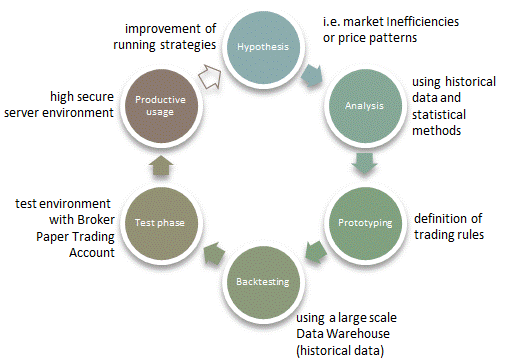

What Is The Process For Algorithmic Trading To Work?

1. the First step is to develop the strategy or generate a trading idea: The trading strategies can be of any type, i.e., Simple MA crossover, Arbitrage, Mean reversion, Quantitative strategies, trend following, or a mix of several strategies.

2. the Second step is to quantify the idea and build a model for it – Rules, Filters, Money Management, etc.

3. After building a model or trading strategy, the next step is to backtest the result of the strategy. We personally believe the backtesting of any strategy is very important. Also, it should be run on multiple time frames to thoroughly test it and be sure you have all possible bugs out of the system before putting it to work with your money.

4. Collect the performance result, and based on the previous results, we decide whether to improve, accept or reject the proposed strategy.

5. If the statistics are not good enough, go back to step # 1.

6. If the strategy does not add significant value to the existing portfolio. Again go back to step # 1.

7. After finalizing the strategy, we implement it on the execution platform and start having it run live.

8. And the final step is to apply risk capital to the account for it to be traded.

Algorithmic Trading Flow Chart Example :

The Next section we are going to talk about the development of various types of algorithmic trading systems.

ALGOTRADES – ALGORITHMIC TRADING FOR THE INDIVIDUAL INVESTOR!

Chris Vermeulen

Technical Traders Ltd.