Algorithmic Trading System Says The Trend Is Down

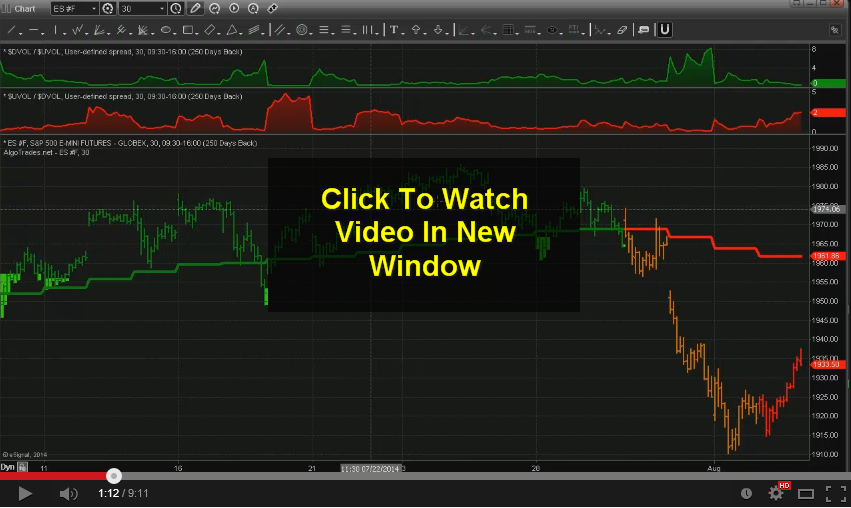

Algorithmic trading system has signaled that the US stock market has reached a critical turning point.

The past two years we see the stock market steadily climb with low volatility. All investors and traders have had to do is simply buy the pullbacks within the stock market and riding the market to new highs. While this has worked out very well to date, most will in for a big surprise when the market trend reverses.

The algo trading system identifies intermediate trends within the market which his idea for swing traders, or active investors looking to get the most of out the market and their capital. These trends typically last 3-12 weeks in length, meaning the US stock market is in for a wild ride.

The big question is if this is just another correction within the bull market, or the start of something much larger. What appears to be forming is a major topping phase (stage 3) in the Russell 2000 index. If this is the case we will see a spike in fear that sends to vix (fear index) also known as the volatility index sky rocketing into the 30s and possibly even 40s, similar to what we say in 2011.

In 2011 the Russell 2000 index formed the same topping pattern we have today. This pattern led to a 30% drop in the index within a few weeks. Will it be the same or is this time the start of an actual bear market?

With the stock market being so frothy and in rally mode for several years. We are due for a major bear market to cleanse the market of greed.

The good thing is that the Russell 2000 is a leading index. Meaning it typically leads the US stock market, which is the SP500, & DOW. We need to watch carefully as the Russell 2000 tests this critical support level of the head and shoulders topping pattern it has formed. A breakdown will trigger mass panic and selling in the financial market.

As of today the SP500 in the DOW still look to be in a strong uptrend at first glance. But the underlying technicals and market internals are telling us otherwise. The average investor is likely buying into this dip once again which they have done for the past couple years. And with the average investor accumulating more stocks at these lofty prices they will likely be the ones left holding the bag when the market crumbles.

Since early April 2014 we have seen heavy distribution within the stock market, though most people don’t realize the distribution is happening, a trained eye can spot when the big money is rotating out of certain high beta stocks, sectors, and indexes.

In January this year we saw the bond market put in the bottom and form a basing pattern. Bonds broke out of this pattern in early May and have been slowly working their way higher since. It’s just a matter of time before bonds jump in value, but it will not take place until the stock market starts a correction which looks to be only weeks away. Money will flow out of the stock market and looks for a safe haven, which bonds are the most popular and predictable.

If we take a quick look at crude oil, it has been trading in a large consolidation pattern for the past two years. Price is nearing the apex of this pattern and a large breakout will happen in due time. With the economy slowly bouncing bottom I feel a breakdown in crude oil will be the likely outcome.

Here is my detailed algorithmic trading system analysis on everything explained above:

Algorithmic Trading System Trend Conclusion:

Short term traders should be looking to short any bounces in the market until our algorithmic trading system signals that a new uptrend has started. Learn more about how the trend and trades are identified in our last article called “Algorithmic Trading Beats Out Market Sentiment, The Silent Killer” – Click Here

Technical analysis and trading is half art, half science. There are ways to fast track this process if you are a do-it-yourself type of trader. A great book that provides the process of learning and what to focus on can be found here: Click Here

Finally, you can have the August issue of INNER-Investors Monthly Newsletter Free: Click Here

Chris Vermeulen

Founder of AlgoTrades Systems