Automated Trade – Another Once Bites The Dust, Ouch!

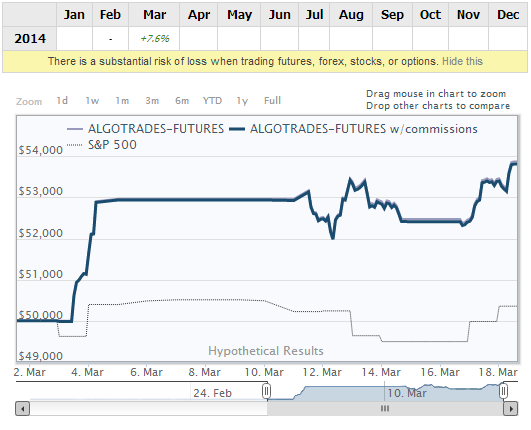

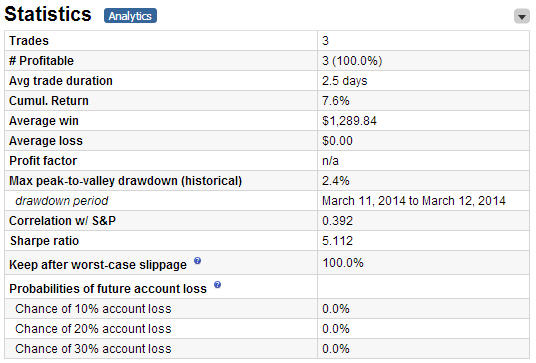

It has been 16 days since we opened the doors to our automated trading systems “AlgoTrades” and today marks the close of the systems third completed trade.

Our algorithmic trading system has a mind of its own which trades based on logic and not emotions. This “Spock” like thinking robot automatically and logically calculates which of its many trading strategies and money management modes it should use according to the stock market markets volatility, cycles, volume and trend analysis.

Two of the automated trades have been based off volatility (emotions from market participants) because of news related events causing price to jump and market internal showing emotional trading. The other trade was a simple buy the dip, sell the rip within the up trend.

There is nothing more rewarding than to see my trading strategy automated and trading live with my capital and clients from all around the world and for clients to be making REAL MONEY without lifting a finger.

Take a look at the algorithmic trading system information below for a visual:

The Automated Trading Strategy for You – Join AlgoTrades Today: Click Here