Invest in Countries Starting Bull Markets – Automated Investing

Automated Investing: Research proves that undervalued equity markets achieve higher future returns over longer term investment horizons.

Studies show that automated investing in markets which have just been through a bear market and their valuations are low is one of the best ways to grow your investment capital.

In 2012 Ireland was one of the countries with lowest PE ratio and a couple years later and 100% rise in the EIRL (Ireland ETF), it is now the second most overvalued country.

Every year there are several markets that are bottoming and starting a new bull market. The key is finding them and being prepared to lock up some of your investment capital in these longer term investments.

On Wednesday I recorded my call with Kerry Lutz of the Financial Survivor Network. We talked about a couple new bull markets that were starting and the one which I like the most.

Listen To Call:Click Here

I believe the best way to be successful as an investor is to actively manage your portfolio. And when I say actively manage it, I mean, you should be rotating your money out of underperforming stocks, sectors, commodities, and index positions and moving that money to fresh investments which more room to rise.

In a week or so I will be doing a detailed report on how many positions a portfolio of various sizes should be holding. You will be surprised with what this report is going to tell you.

In short, the less the trades you make and the fewer positions you hold in your portfolio can make a dramatic impact on your portfolio volatility, time commitment, stress levels and performance.

Diversification between a small selection of investments and strategies is vital. This is not rocket science, anyone can do it and I will show you how.

Anyway, let’s get back to undervalued markets…

You have to invest in markets and sectors that have just gone through a bear market. By doing so you can look forward to years of upside growth.

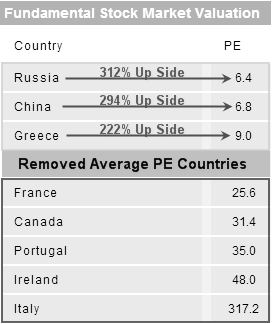

Cheapest Markets, and Most Expensive Markets

This table shows the valuations of world markets with the most recent data available.

Looking from an evaluation stand point and long term investing Russia, China and Greece are the most undervalued. And if we take an average PE ratio of the majority of counties of 20, then we can calculate a rough percent return each country should provide in the coming years.

Keep in mind, these markets can still be volatile and if you are a short term trader its best not to trade based off fundamentals and valuation. Hedge fund robots and my automated investing system do not and most US stock market participants do not either.

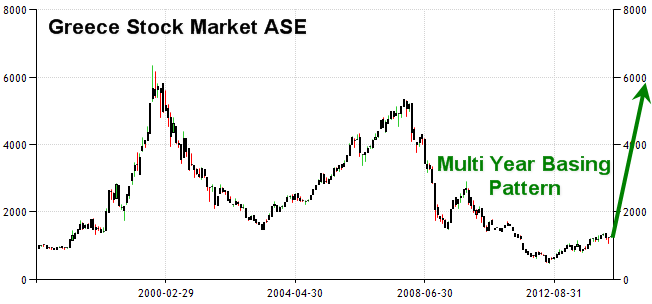

Charts of Undervalued Country ETF’s

These charts just show a simple snap shot and their first upside target before they run into some long term resistance.

Automated Investing Conclusion:

In short, this report is simple and uses a logical strategy. Again, it is critical to have a diversified portfolio with completely unrelated investments (different countries) and also to use different investment strategies and time frames to balance portfolio volatility.

I believe you should have long term holdings and short term holding using both long and short positions. Short positions allow you to profit from a falling market, and some of the biggest and fastest money can be made with this strategy and is a vital strategy within my automated investing system.

Learn About My Investing Strategy Here: www.AlgoTrades.net

Chris Vermeulen

CEO & Founder

AlgoTrades.net